When entering an amortization expense journal entry, it is important to remember that the balance sheet and income statement are impacted. The prepaid expense account or the value of the intangible asset on the balance sheet is credited or reduced, and the expense account is entered as a debit or increased. The journal entry should have support, such as an amortization table and listing of prepaid expenses attached to it, as support for the entry. Unsupported prepaid assets on the company’s balance sheet pose a risk to accountants and decision-makers alike. By recording these expenses accurately through journal entries, companies can reflect the ongoing consumption or expiration of their intangible assets.

Leveraging AI to address challenges in staffing accountants

To record an accrual, an accountant would debit an expense account and credit a liability account. It’s important to remember that not all intangible assets have identifiable useful lives. It expires every year and can be renewed annually without a renewal limit. This situation creates an asset that never expires as long as the franchisee continues to perform in accordance with the contract and renews the license. In this case, the license is not amortized because it has an indefinite useful life.

What is the difference between depreciation and amortization?

Overall, adjustment entries play a crucial role in ensuring the accuracy and reliability of financial statements. Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations. A lag in recording which journal entry records the amortization of an expense transactions can also lead to incorrect financial statements. This can happen when transactions are not recorded in a timely manner or when they are recorded incorrectly. To avoid this mistake, it is important to record transactions as soon as possible and ensure that they are accurate.

#5. Balloon payments

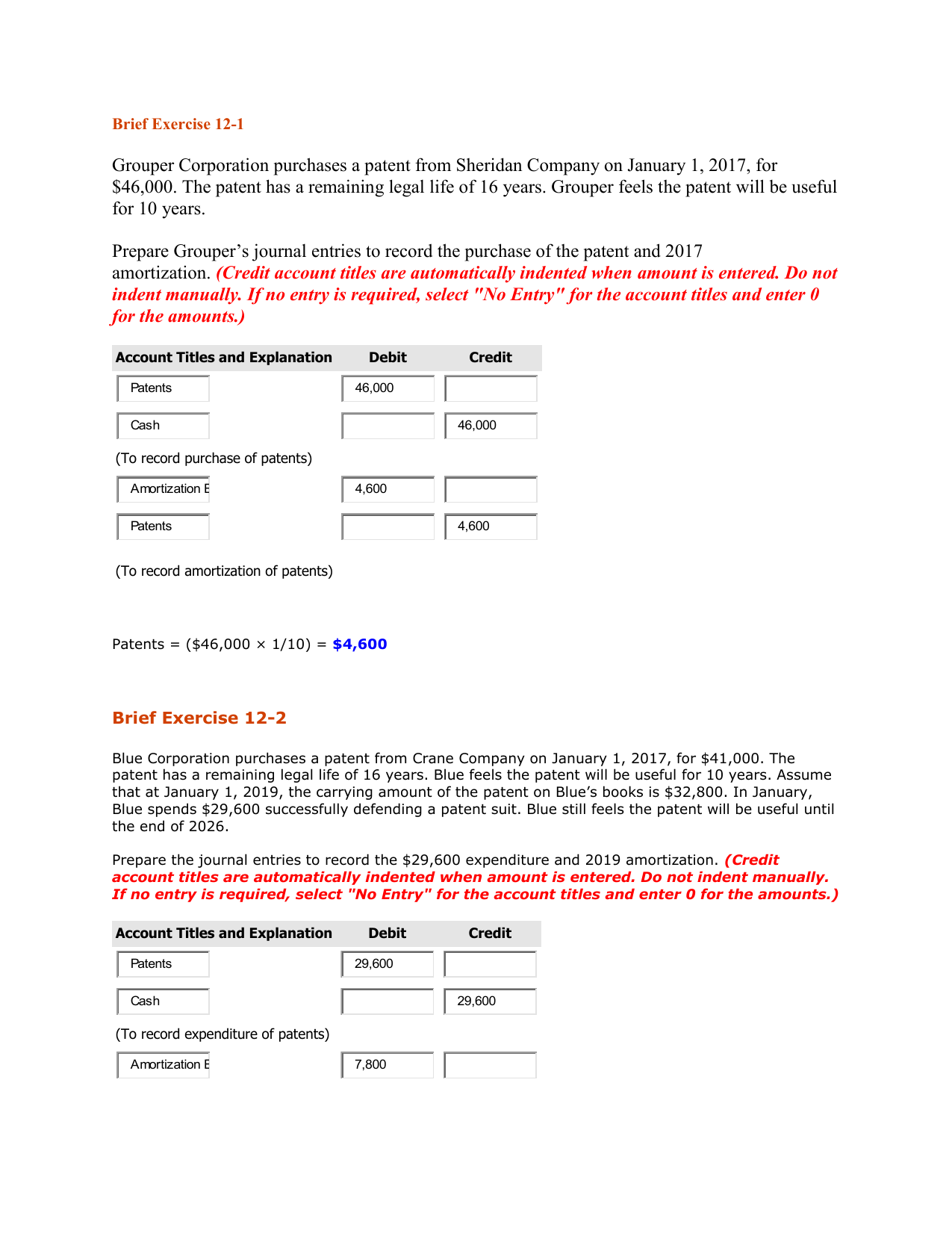

Amortization expense is typically calculated using a schedule that illustrates a beginning balance, and a series of equal expenses, that reduce the beginning balance to zero. The amortization table can be relatively simple and is oftentimes created in Excel. Dividing the beginning balance by the number of amortization periods typically yields the amortization amount. General ledger accounting software can automate the calculation of amortization expense.

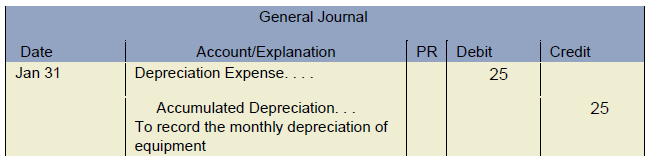

Journal Entry for Accumulated Amortization

Another difference is that the IRS indicates most intangible assets have a useful life of 15 years. For example, computer equipment can depreciate quickly because of rapid advancements in technology. It should be noted that computer software is an intangible asset.

What are the journal entries for amortization expense?

- Amortization is an accounting technique used to spread the cost of an intangible asset over its useful life.

- Amortization is the process of spreading out an intangible asset’s cost over a certain period of time in accounting.

- They ensure that both income statements and balance sheets present a more accurate representation of their financial position.

- The accumulated amortization is the contra account of the intangible assets.

Unlike depreciation (which refers to tangible assets), amortization deals with the systematic reduction of an asset’s value on financial statements. Think of it as spreading out the cost of an asset over its useful life rather than expensing it all at once. You must use depreciation to allocate the cost of tangible items over time. Likewise, you must use amortization to spread the cost of an intangible asset out in your books.

For intangible assets, knowing the exact starting cost isn’t always easy. You may need a small business accountant or legal professional to help you. It reflects as a debit to the amortization expense account and a credit to the accumulated amortization account. Accumulated amortization is a contra account to the intangible asset in the balance sheet. Likewise, the balance of accumulated amortization for the intangible asset should never be more than its cost.

They ensure that both income statements and balance sheets present a more accurate representation of their financial position. The journal entry is debiting amortization expense on income statement. The accumulated amortization is the contra account of the intangible assets.

This could be due to an error in the original journal entry, the need to accrue expenses or revenue, or the need to record depreciation. The useful life of intangible assets is the duration it contributes to your business’s value. For example, a patent that lasts 20 years would have a useful life of 20 years.

The reported balance of intangibles will decrease, but we can still see the original cost. The amortization expense is the allocation of intangible assets balance to the expense on income statement. The company will allocate the cost of intangible assets over the useful life and record them as expenses. The assets will be useless at the end of the useful life, so the company has to record it to expense. However, instead of recording expenses at any particular period, they spread them equally over the useful life.