Ireland has the benefit of glamorous solutions and you can vistas, it is therefore no wonder that folks from all over the nation started here which have hopes of setting-up root and purchasing property.

Navigating the borrowed funds business due to the fact a different federal may sound hard, this is why we have written this informative guide to aid international nationals understand the Irish home loan markets and you may navigate the loan software processes.

Can foreign nationals score a mortgage within the Ireland?

The simple answer is yes’. While legitimately resident from inside the Ireland, subject to certain conditions, you are permitted get home financing inside Ireland. That it applies to European union/EEA residents, in addition to low-EU/EEA people with good Stamp step one, Stamp 1G otherwise Stamp 4.

Depending on the specific criteria off a loan provider, besides demonstrating affordability, might generally be required to match the bank than simply your have been residing and dealing inside the Ireland to own the absolute minimum period (age.grams., 12 months).

Which mortgage loans can be found in Ireland?

There are many mortgage products being offered so we recommend that you feel regularly the many form of mortgage loans offered and you will how they functions.

The loan affairs offered differ getting consumers depending on its certain assets trip. Like, these products offered to very first-date people may differ out-of people accessible to a great mover or someone who was purchasing an investment property.

The best financial device is new cost financial. Lenders figure out how far you should pay every month to repay the borrowed funds towards the end of your own title. Your month-to-month money might possibly be composed of:

- An attraction payment toward mortgage, and you may

- A money payment paid the balance.

Initially, most of your money goes to your make payment on focus but due to the fact financial support count reduces, the interest part decreases and a lot more goes to the settling the administrative centre number.

Which rates of interest use?

Whenever choosing home financing, the speed was a key basis because plays a significant part in how far you pay to help you a lender for each and every few days, and in overall, along the duration of the loan.

Varying Prices

– Promote self-reliance and may even allow you to pay additional off the mortgage, expand the definition of or finest it without paying a penalty.

Fixed Rates

– Offer confidence since you know exactly just how much the monthly payments is and they will maybe not boost with rates of interest.

– Sadly, you will not benefit from a decrease in the interest rate on duration of your financial. Subsequent, when you need to bust out regarding a fixed speed, elizabeth.grams., if you opt to switch loan providers from inside the fixed rate several months, you may have to pay a penalty commission.

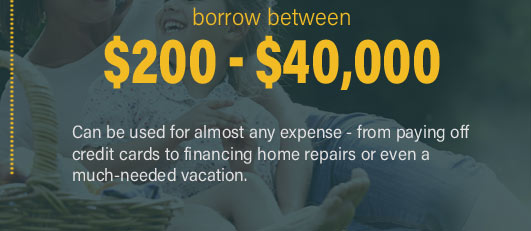

How much could you acquire?

Brand new Main Bank off Ireland enjoys financial strategies in position, mode limitations on the amount of money loan providers can be provide in order to you, playing with Financing-to-Really worth (LTV) constraints and Financing in order to Money (LTI) limits.

- LTV limitations imply that you need to have a certain deposit count before you get home financing. These types of limits will depend on regardless if you are an initial-date visitors e.g. 90% https://paydayloancolorado.net/kim/, the next and you may subsequent visitors elizabeth.g. 80%, or a residential property client e.grams. 75%.

- LTI restrictions maximum the quantity you could potentially borrow against the foundation of one’s revenues. This limit does not connect with borrowers according out of financial support services otherwise altering your own financial.

It is recommended that you earn proficient inside the home loan conditions to make certain that you know what lenders happen to be these are. The financial glossary guide simplifies home loan slang that you will come upon throughout your financial travel.