First Opposite Financial Certification

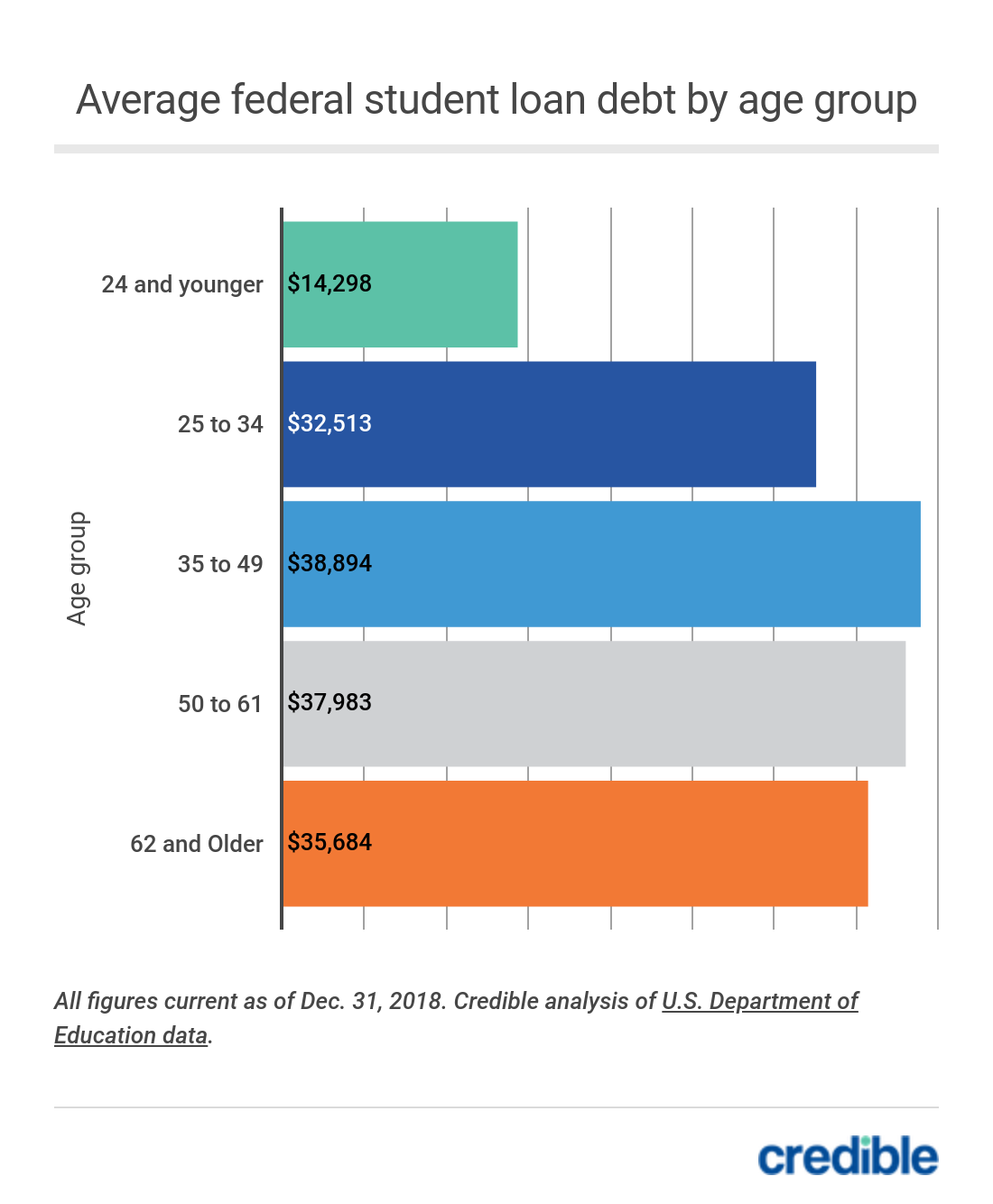

- You (or perhaps you to definitely debtor) have to be 62 otherwise earlier. Inside Colorado, each other partners have to be no less than 62.

- Your home have to be just one-house, 2- to help you an excellent 4-equipment house or FHA-recognized condo

- You need to see minimal borrowing criteria

- You should found opposite financial guidance from a HUD-acknowledged guidance agencies

- You ought not getting outstanding to the any federal debt

- You should be a homeowner and either house downright or keeps high guarantee

- You ought to inhabit the house as the no. 1 house (meaning you need to alive here six+ months annually)

Sort of Contrary Mortgages.

Plus the HECM opposite home loan, Fairway offers other types of contrary mortgages to produce selection when trying to find the best complement to the old age package.

- Particularly, for people who own a premier-worth possessions, a jumbo contrary mortgage also provides a greater guarantee restriction one to you can borrow against rather than a classic HECM reverse financial (by which the current limitation you’d face try $step 1,149,825).

- And, if you’re looking to find a different home, you will find a face-to-face home mortgage particularly for that-its called HECM for sale. You are able to our very own HECM for purchase (H4P) calculator so you’re able to quickly rating a price

The way you use A contrary Financial

There are lots of days in which an other home loan are the best options for your. Here are a number of uses and advantageous assets to opposite mortgage loans.

Perform memories that you’re happy having at the sundown regarding life. It is unfortunate when folks to use home near the top of several loans in Weeki Wachee thousand dollars from inside the security and you may miss vacations, grandchildren’s university graduations, if not a meal out because budget is actually tight. Zero well-definition youngster perform previously request you to pinch pennies so they really have a more substantial household collateral heredity after you pass away. They would rather have you love old age using them.

2. Used to meet instant cash needs

In any rough economic minutes, there are many different things that you could potentially make use of if you really have dollars. Such as for example, you could potentially let a grandchild rescue their home out-of property foreclosure otherwise help them which have university since the will set you back rise over $20,000 per year at personal colleges. Think about it-if you had an additional $100,000 on your hand now, which are you willing to give it to help you, or what otherwise do you really do inside it? Along with your expertise and you can sense, we realize you could think of a lot of choice.

step three. Use to boost legacy getting foundation or perhaps the next age bracket*

If you are using an expert financial advisor on life insurance coverage world, you could find there are numerous situations available for people who have way too much cash, together with particular that may to accomplish over a made-out-of domestic you may in itself. Speak to your financial mentor throughout the products that is generally offered for you along with your particular problem.

cuatro. Use to avoid draining most other investment*

With the loan arises from a contrary mortgage can potentially assist your investment stay longer. The majority of people explore reverse mortgages within a proper economic old age package. Confer with your financial mentor on how best to use which mortgage into your complete economic package.

Discovering more info on contrary mortgages

To learn more, take a look at different reverse mortgages possibilities or contact your local Fairway Contrary Financial Coordinator now.

** There are some issues will cause the mortgage in order to adult and you will the bill being due and you will payable. The new borrower remains responsible for spending property taxation and you can insurance rates and you can maintaining our home: borrowing at the mercy of age, possessions, and some limited obligations official certification. System prices, fees, terms, and criteria are not available in the states and subject to change.

There are even ongoing will cost you, which include yearly MIP (0.5% of your an excellent loan balance) and loan repair fees (Fairway does not charge people), which might be added to the mortgage balance and will accrue interest.