If you are searching to assist an excellent 1099 company buyer safe good financial, you first need understand their particular finances. Even when a beneficial 1099 customer’s conditions for acceptance are similar to people off a vintage W-2 visitors, the process is often so much more stringent. Like, the 1099 consumer would need to bring numerous years’ value of papers (e.grams., income comments, tax data files, evidence of a career balance). Mortgage officers have to be knowledgeable about exactly what such customers face and you can in a position to give ways to enable them to successfully navigate their mortgage loan travel.

Knowing the 1099 specialist surroundings.

A great 1099 company, also called a different company, is a kind of thinking-operating staff member exactly who always provides properties to companies or website subscribers with the a contract foundation. This new 1099 refers to the Internal revenue service taxation form these professionals need to use to help you allege their earningsmon professions the place you can find 1099 designers were self-employed creatives (elizabeth.grams., editors, musicians and artists, performers), doctors/dental practitioners, and you will real estate agents.

As with any work type of, discover benefits and drawbacks to help you are a good 1099 company. They often gain benefit from the self-reliance having command over their own plan and you can strategies. With regards to the field, 1099 designers likewise have the potential for higher earnings since they negotiate their rates. They are able to also benefit from individuals taxation write-offs about providers expenses, which will help clean out its taxable earnings.

There are cons, also. These types of experts generally speaking do not discovered benefits, such as health and later years plans, for example W-2 personnel would. Also responsible for paying thinking-a job taxation together with public coverage and you may Medicare. Possibly the most significant drawback is that their income can be unpredictable as they can change between attacks of being from inside the large consult and attacks that have simple potential.

Pressures 1099 designers face inside the acquiring a mortgage.

Getting a mortgage loan while the a beneficial 1099 contractor can also be present numerous pressures versus traditional W-2 group. MLOs might be happy to offer consultative suggestions on their 1099 customers regarding this type of demands in the mortgage application process.

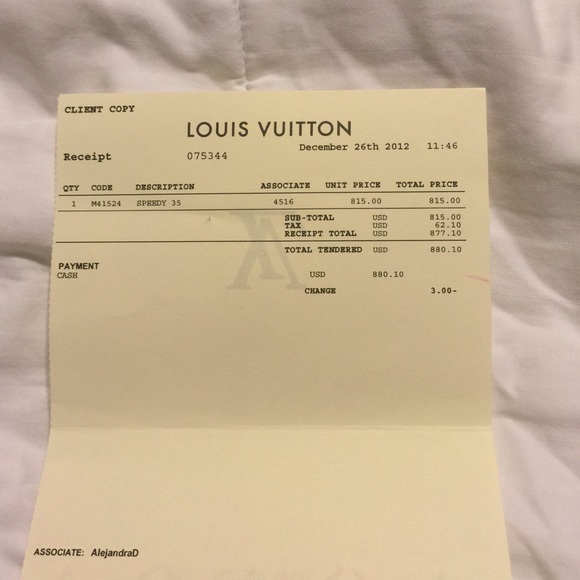

- Income Confirmation. An essential part of one’s mortgage processes is offering recorded research of money. As the 1099 contractors don’t get W-2, this might be complex on account of income action seasons more than season. In which antique teams is also fill out W-2s and you may salary stubs, 1099 builders will require tax statements, profit/losings statements, and you will bank statements to verify their money history.

- A career Confirmation. Lenders usually request at least 24 months off stable employment, thus designers who do work toward a task-by-project basis have problem exhibiting consistent employment. Thanks to this, lenders may prefer to look for numerous years of notice-a career payday loans Tidmore Bend background to show balances.

- Debt-to-Earnings Proportion. An effective borrower’s DTI is commonly thought of the loan providers to choose how the majority of a mortgage they may be able afford in the believe of their most other expenses. Sometimes, having contractors who have abnormal income, DTI calculation might be challenging.

- Improved Scrutiny. Area of the financial processes are assessing risk, which includes brand new personal study regarding a beneficial borrower’s financial character from the a keen underwriter. Designers get face so much more stringent criteria, like a top credit history or interest rate, making upwards to possess a sensed increased chance.

- Mortgage Program Restrictions. Particular loan apps, such as for example bodies-backed money, have money confirmation criteria one to designers will find challenging. Particularly, they might prioritize borrowers with uniform income ideas.

Exactly how MLOs let the 1099 clients address mortgage pressures.

Mortgage officials are acquainted the possibility obstacles the 1099 builder subscribers have a tendency to deal with. By understanding the nuances of each and every of your own after the common pressures, MLOs will receive a simpler day tailoring their method to give an educated services to their members.