Section Menu

Congratulations in your choice to find a house. The process might be exhausting and you may exhausting, but it also was fulfilling and you may satisfying particularly if you discover how deal is accomplished. This guide is intended for beginners in america real estate sector.

When you yourself have chose to pick, one thing to envision is actually, “What sort of home create I need to get?” This is very important, because you don’t want to buy a house which is too quick, otherwise too-big. You’re capable afford a six-rooms family, you will most likely not you would like a half a dozen-rooms house. When you’re a single person do you want all that area? Would an excellent condo be a much better get? Think about whenever you are partnered? So now you was two. But what if you are going having youngsters? When you are that’s a conference that may n’t have occurred, or may not are present, how will you arrange for one?

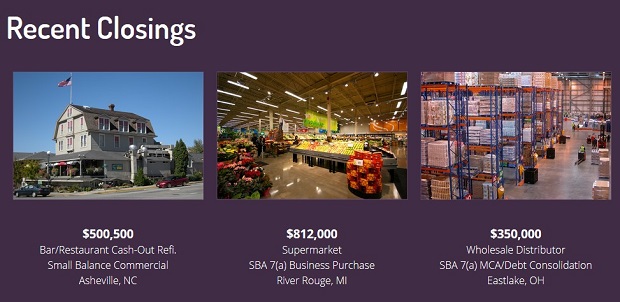

Getting a mortgage

A mortgage was financing provided to buy some possessions. To get the financing, you’ll have to go through a loan application process. The borrowing could well be seemed, checks will have to be performed for the possessions. Immediately after these items is accomplished, owner therefore the consumer see an ending so you can signal the appropriate import out-of control papers. This is usually complete thanks to a mortgage broker, and also the price try closed from the a concept business.

Getting the borrowing from the bank in a position to possess assessment of the a potential mortgage organization is vital to having the money for your home. Unless you are separately rich might you would like its help. There are several major credit people that offer a research. Constantly discover a little payment for the report if you do not was in fact recently refused having borrowing from the bank. you want to get a copy of one’s declaration irrespective of because will say to you where you are towards a cards basis.

Once you have obtained a duplicate of your report and possess deciphered they your next need to boost one discrepancies that seem. Should you get all of them fixed very first, then you need not get it done later on in the event the mortgage providers needs a clarification. And they will. This is where you might extremely score before the games. A little understood truth can help you aside here. You are invited by the Reasonable Credit rating Act to add an announcement for the credit report. This is to 100 conditions and teaches you every discrepancies on your own statement. It does not excuse them, however, explains all of them. Surprisingly when you yourself have a couple later money into the credit cards it will hurt your in the getting the borrowed funds otherwise charge a fee a lot more finally in the closing. A description that you are currently perhaps out of work, or simply just got behind you are going to save the mortgage and the a lot more affairs you’ll have to apply for New Jersey installment loan online purchase.

Looking a representative

There are numerous real estate agents in just about any area, so that you get a choice of who to utilize. Make sure you come across somebody who are legitimate, and with who you feel at ease. As soon as your broker understands what sort of property we want to purchase, he/she will begin to direct you attributes. You will find things to recall, and you will concerns to ask, once you consider a property:

- How old ‘s the heater/air conditioning system? Air conditioners and you can heaters manufactured to help you past anywhere between ten and you will twenty years.

- How old is the roof?

- What age may be the devices, and will it feel staying in the house or property?

- What are the neighbors and the area including?

- In a number of properties, such as for instance condominiums otherwise townhouses, you’ll have to spend a mainenance commission. What is the cost of repairs in case it is provided? Precisely what does the maintenance protection? Exactly what it constantly covers are yard repair, water, sewer, use of prominent business, an such like. This may will vary so make sure when you ask it of one merchant you apply it across the board. Keep this in mind will not be folded to your homeloan payment, it does usually become another type of percentage you are going to need to spend. What’s more, it could have a unique deadline.

Taking a property inspector

The new check is very important. It will find out items you decided not to possess identified regarding in earlier times and you may alert you so you’re able to possible troubles down the road. This new inspector is going to be signed up in a few disciplines like plumbing and you may electronic along with strengthening code evaluation.

You can find a summary of inspectors in your regional Red Pages. Whatever they does to have a fee was examine the latest equipment, new electricity integrity of the property. They’re going to plus inspect brand new roof, air conditioning units, and architectural facts. When they very squared out they will certainly even render with each other a termite inspector to seem to to possess termites.

After every one of the checks are done you will be offered a report to send with the provider and you will a good level of day will be arranged to your merchant to fix new dilemmas found. The vendor may well not agree with the inspector’s works. Which is great, permit them to hire their own yet contemplate your since the client come into manage. If the seller does not consent otherwise will not enhance the difficulties receive, you have a legal cause to-break the fresh package and you may leave brand new income.