Your own lender knows how your rate of interest will get calculated, and we thought you will want to, also. Learn more about the standards that affect the interest.

If you find yourself like most anybody, we would like to obtain the low interest as possible get a hold of for your home loan. But how can be your interest determined? And this can be tough to find out for even brand new savviest out-of mortgage shoppers. Being aware what things influence the mortgage interest rate can help you best plan the brand new homebuying techniques and also for negotiating the mortgage mortgage.

Your own lender knows just how your rate of interest becomes determined, and we think you really need to, too. Our Explore Interest levels product enables you to connect in a number of of elements which affect their personal loans Nebraska interest rate. You can observe what rates you can assume-and exactly how changes in such circumstances may affect rates to possess different types of funds near you.

Actually preserving a fraction of a per cent on the interest rate could save you thousands of dollars along the lifetime of their real estate loan, it definitely pays to prepare, research rates, and you may examine offers.

Armed with suggestions, you could have convinced discussions having loan providers, ask questions, and you can know your loan possibilities. Rates, identical to gas prices, can also be change out-of day to day and every year. When you find yourself movement on the interest rate marketplace is outside of your own manage, it’s a good idea-identical to with gas prices-attain sense about what exactly is typical. In that way, you will have a sense of whether or not mortgage loan quotation your discovered appears to be from the listing of normal rates, or you is always to ask significantly more concerns and you will always store to.

1. Fico scores

Your credit score is but one component that could affect the desire rate. Generally speaking, consumers having high fico scores found straight down rates of interest than users which have straight down credit scores. Lenders make use of credit scores in order to assume exactly how credible you will end up during the spending the loan. Credit scores is actually calculated according to research by the advice on your own borrowing report, which will show information about your credit report, together with your funds, credit cards, and you may payment history.

Earlier financial looking, pick is to try to look at the credit, and you will comment your credit history having errors. If you discover one errors, disagreement them with the credit revealing providers. An error on your credit file can result in a diminished get, that will stop you from qualifying getting better financing pricing and you may terminology. Required a while to answer mistakes on your own borrowing profile, very look at the borrowing at the beginning of the method.

Enter your credit rating assortment into the Talk about Rates of interest unit to acquire information regarding the fresh new costs out there. If not discover their credit scores, there are various the way to get it.

You are able to try out the fresh product observe the manner in which you you will help save more about the mortgage rate of interest having highest borrowing from the bank scores. Find out about steps you can take to increase their credit scores.

2. Household area

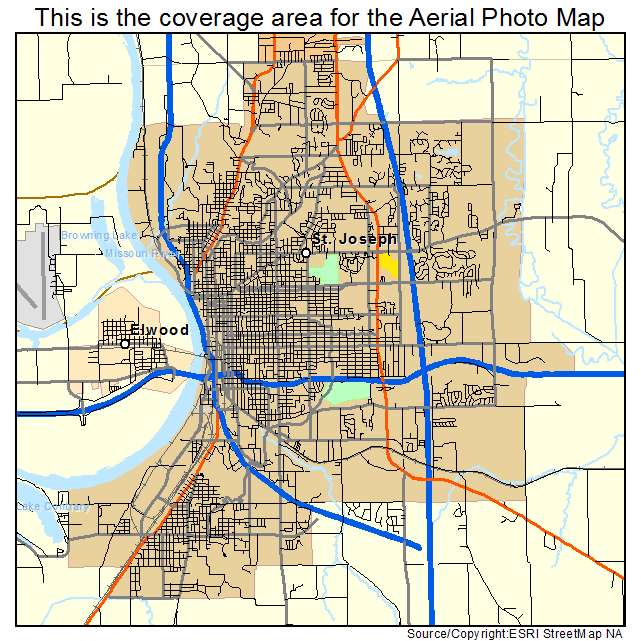

Many lenders offer some additional rates of interest dependent on what condition you live in. To discover the really exact pricing playing with our very own Explore Interest rates device, you will have to installed your state, and you can based on your loan number and loan kind of, their county also.

If you are looking to buy when you look at the an outlying urban area, all of our Talk about Interest rates equipment allows you to score an atmosphere out-of pricing on the market, but you’ll want to research rates which have numerous loan providers, plus regional lenders. Some other lending establishments could possibly offer some other mortgage products and cost. No matter whether you’re looking to buy from inside the an outlying otherwise city, talking to multiple loan providers will help you to understand all the options available for you.