Depreciation is generally an estimate, and there are various methods for calculating depreciation. Investors who rely heavily on book value analysis are typically looking for good stocks that are temporarily underpriced by the investment community. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market.

Market Capitalisation = Market Value of a Stock x Number of Outstanding Shares

The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently. Companies with lots of real estate, machinery, inventory, and equipment tend to have large book values. In contrast, gaming companies, consultancies, fashion designers, and trading firms may have very little. They mainly rely on human capital, which is a measure of the economic value of an employee’s skill set.

- BVPS is typically calculated and published periodically, such as quarterly or annually.

- The following day, the market price zooms higher and creates a P/B ratio greater than one.

- In closing, it’s easy to see why the book value per share is such an important metric.

- This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided.

- It had total assets of about $252.39 billion and total liabilities of approximately $161.83 billion for the fiscal year ending January 2024.

Is a higher PB ratio better?

This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible keep ghosts off the payroll assets relative to their intellectual property and human capital (labor force). These intangibles would not always be factored in to a book value calculation. The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS. If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases.

Is BVPS relevant for all types of companies?

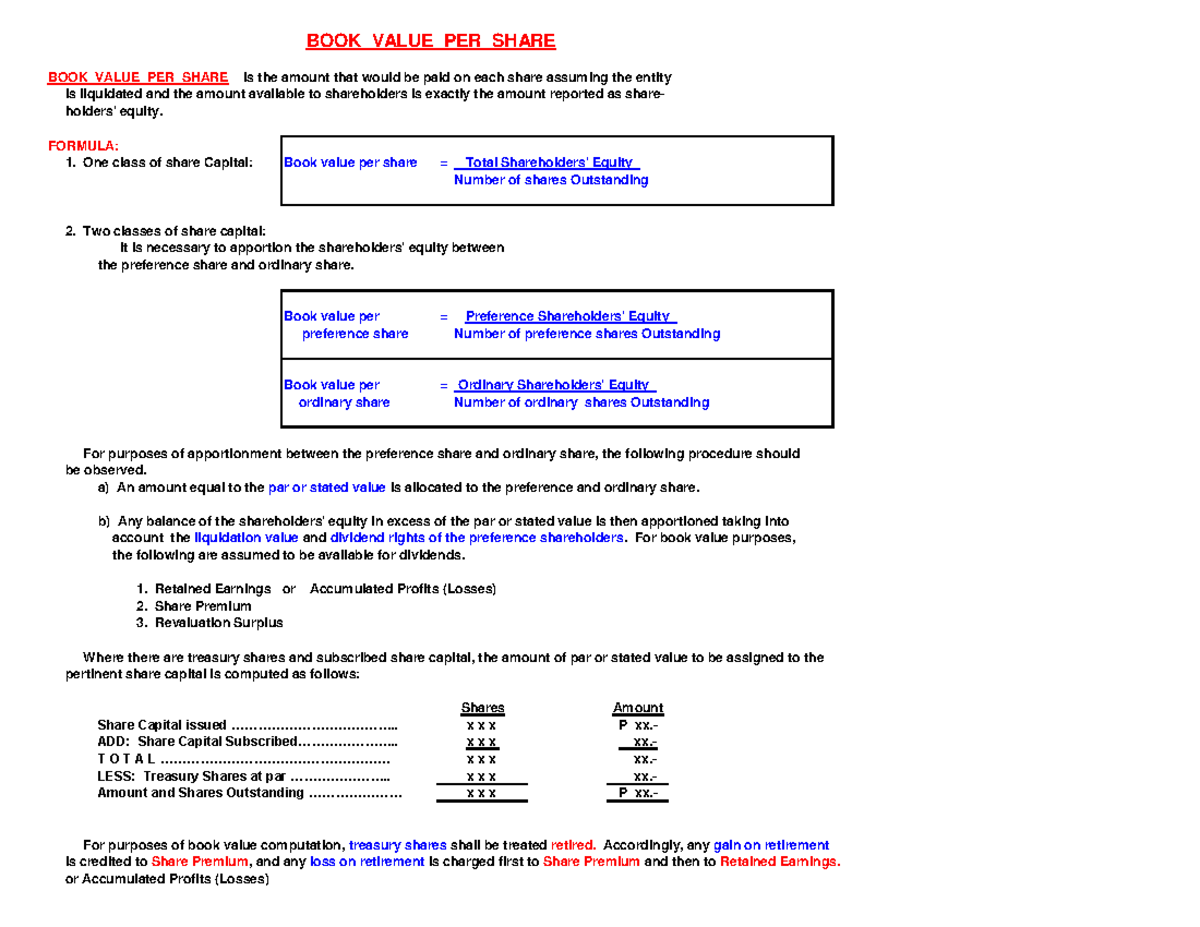

As a result, investors must first determine the market capitalisation of a company by multiplying the current market price of its stocks by the total number of outstanding shares. The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares. To put it simply, this calculates a company’s per-share total assets less total liabilities. Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases.

How Does BVPS Differ from Market Value Per Share?

On the other hand, the number of shares outstanding almost always remains the same. That number is constant unless a company pursues specific corporate actions. Therefore, market value changes nearly always occur because of per-share price changes.

Methods to Increase the Book Value Per Share

However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading. Investors typically view a P/B ratio below 1.0 as an indication of undervaluation. Although the meaning of a “good PB value” differs by industry, some experts consider any value below 3.0 to be favourable. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. InvestingPro offers detailed insights into companies’ Book Value Per Share including sector benchmarks and competitor analysis.

ConclusionWhen investors need to assess a company’s valuation, the price-to-book, or P/B, ratio is a helpful financial tool. It is important to analyse other financial indicators and market developments rather than using them individually. Many share market apps offer various tools for stock market investment nowadays which may help you find out what is good PB ratio for a company..

You can use the book value per share formula to help calculate the book value per share of the company. Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities. A simple calculation dividing the company’s current stock price by its stated book value per share gives you the P/B ratio.