And these types of, moreover it provides personal loans, savings and you may checking membership, etc

The money that you get out-of a home equity loan normally be used to increase and you will remodel your home. Can help you many different types off home improvements in the house or even entirely transform the appearance of your property.

A house equity mortgage might be used for home repair simply. It should not be used in almost every other objectives, such as for example happening a secondary, to find certain luxurious situations, gonna people, etc. The other everything is not well worth making use of the money you have made of keeping your house since security.

The credit limitation is different a variety of funds, but when you get a high borrowing limit, then chances are you should not use they regarding the wrong way. You need to only pick those items for your home repair, that are needed in actual life, in lieu of overspending towards the items that try of no use.

You’ll find very different categories of programs that you can train via your home renovation, including strengthening a property office in the house. This will help enhance the full value of company site your house plus the resale value.

The eye that you must spend to the loan try tax-deductible in the example of domestic collateral financing.

The interest cost away from domestic equity funds and HELOCs was straight down than other types of finance, particularly personal loans.

Playing with a property collateral loan to help you redesign your home is an effective extremely swift decision since it can help improve the collateral in your house.

This is certainly a credit partnership which provides HELOC via on the internet setting. Only one off-range department associated with partnership is present. The interest cost provided by brand new Alliant borrowing commitment commonly fixed. The fresh charge away from Alliant borrowing from the bank relationship are very lower and also have versatile conditions eg frequent withdrawal, etc.

The newest Align Credit Union will not promote lenders that have fixed interest levels to your consumers, so this is regarded as among the many restrictions out of Alliant Borrowing from the bank Commitment.

There’s only one physical part off an enthusiastic allied borrowing from the bank commitment that is situated in Chicago. For this reason, never assume all consumers gain access to the newest actual branch and get to use the web based system.

Since the talked about above, this new aimed borrowing from the bank partnership merely brings HELOC and does not promote one security loans at the fixed rates. Although not, the financing commitment will give you an option to refinance your HELOC.

BMO Harris Financial has the benefit of home guarantee fund and additionally HELOC in order to individuals. The brand new fees energized by this bank also are suprisingly low. It has got of several twigs global.

House guarantee loan equipment choice?

It bank brings household security loans so you’re able to borrowers during the a fixed interest, therefore the borrowers might even buy a leading amount of cash from the bank. But for that it, there was a condition that brand new consumers have to have the absolute minimum credit score out of 700.

In order to qualify for one another house equity financing and you can HELOC using this lender, you need to give specific recommendations toward lender, like your income, loans, credit score, credit history, etcetera.

In order to qualify for a house collateral mortgage, the fresh new debtor need a credit rating away from 700. A credit history out of below 700 tends to be perhaps not accepted. While the requirement from credit score to possess HELOC is a little all the way down, which is doing 680.

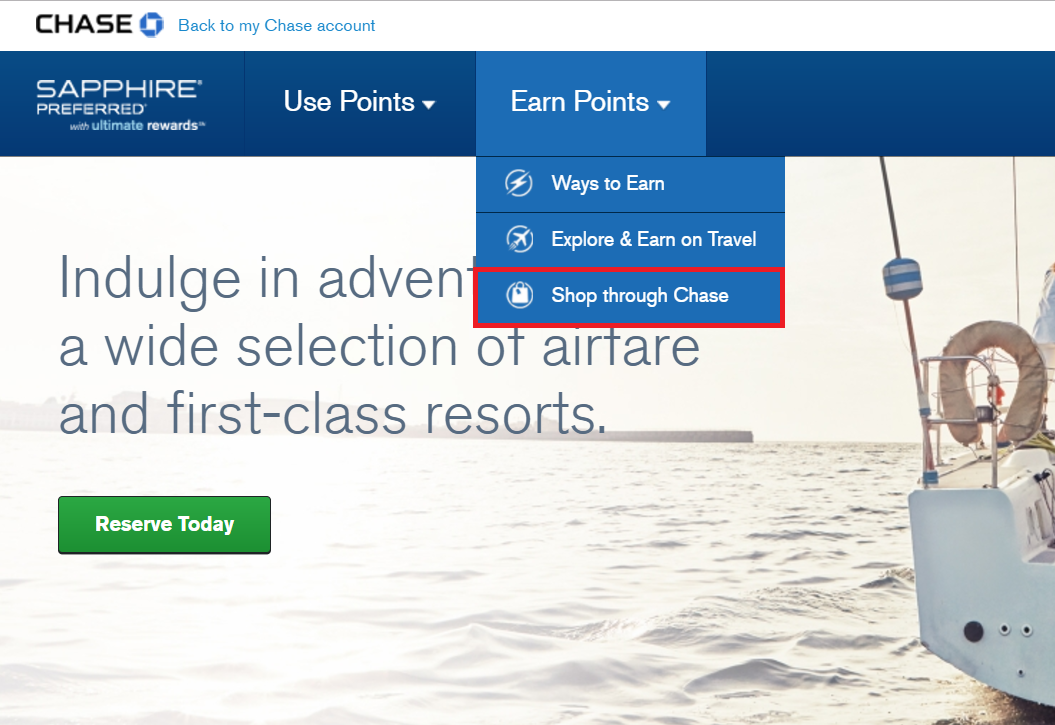

Chase ‘s the most significant financial in the usa, plus it brings various monetary properties such as for example discounts and you will checking account, handmade cards, household, collateral, loans, etcetera. In addition, it provides on line banking features. The loan count using this lender initiate out of $25,000.