This is an excellent method for the absorption of overhead costs in industries where much of the work is performed with the help of machines. Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period. Additionally, absorption costing can obscure the true variable cost of production, making it more challenging to conduct break-even analysis and perform cost-volume-profit (CVP) analysis.

Absorption Costing Explained, With Pros and Cons and Example

This capitalization results in a lower taxable income in the current period, as the recognition of these costs is postponed until the sale of the inventory. Consequently, companies may experience a temporary reduction in their tax burden, which can be strategically significant, especially for businesses in capital-intensive industries where large inventories are common. Variable costs can be more valuable for short-term decision-making, giving a guide to operating profit if there’s a bump-up in production to meet holiday demand, for example.

- Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level.

- Absorbed cost allocations for one product produced may be greater or lesser than another.

- The total amount of overhead accumulated for a production department is ultimately charged to the various cost units of that department.

- Both costing methods can be used by management to make manufacturing decisions.

Steps Involved in Overhead Absorption

In addition, the use of absorption costing generates a situation in which simply manufacturing more items that go unsold by the end of the period will increase net income. Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced. Therefore, as production increases, net income naturally rises, because the fixed-cost portion of the cost of goods sold will decrease.

Percentage of Direct Material Cost

Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Advantages and Disadvantages of Absorption Costing

A company must pay its manufacturing property mortgage payments every month regardless of whether it produces 1,000 products or no products at all. It may see an increase in gross profit after paying off the mortgage or finishing the depreciation schedule on a piece of manufacturing equipment. These are considerations that cost accountants must closely manage when using bookkeeping insuranceing. It is best suited to those units of production where overheads depend on both direct materials and direct labor. We know that both direct materials and direct labor determine the nature of overheads. The prime cost, comprising direct materials, direct labor, and direct expenses, is significant in every type of organization.

Why Use the Absorption Costing Method?

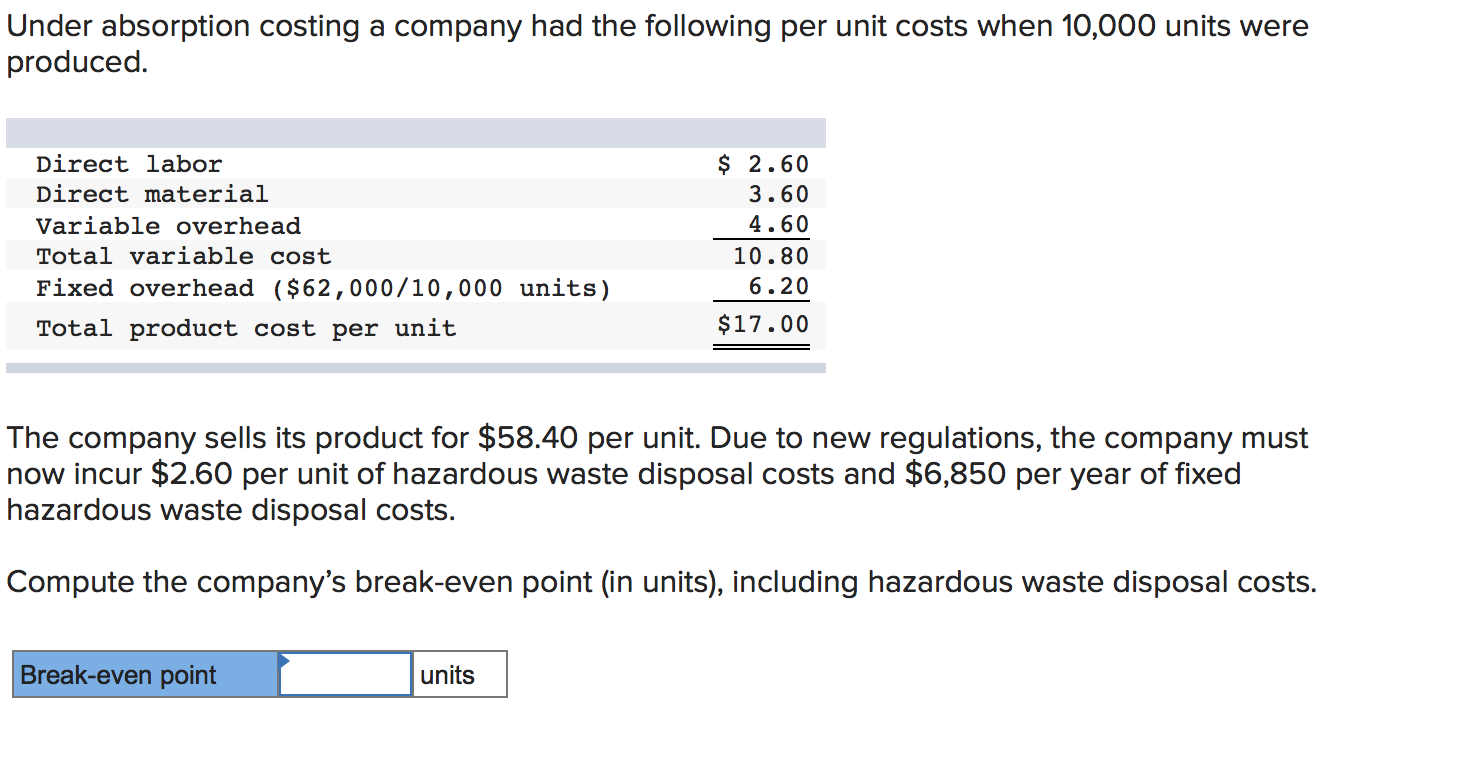

In absorption costing, fixed costs such as rent, salaries, and utilities are allocated to products along with variable costs. This allocation is based on a predetermined rate, often driven by the normal capacity of production facilities or a specific activity base. For instance, if a factory is capable of producing 10,000 units in a month, and the fixed costs for that period are $50,000, then each unit would absorb $5 of fixed costs. This method ensures that all costs of production are captured in the cost of inventory, leading to a more comprehensive understanding of product profitability. However, the allocation of fixed costs can sometimes result in fluctuations in unit costs when production levels vary from the norm, which can affect the comparability of financial results over different periods. Another method of costing (known as direct costing or variable costing) does not assign the fixed manufacturing overhead costs to products.

Under absorption costing, all manufacturing costs, both direct and indirect, are included in the cost of a product. Absorption costing is typically used for external reporting purposes, such as calculating the cost of goods sold for financial statements. Finally, remember that the difference between theabsorption costing and variable costing methods is solely in thetreatment of fixed manufacturing overhead costs and incomestatement presentation. Regarding selling andadministrative expenses, the only difference is their placement onthe income statement and the segregation of variable and fixedselling and administrative expenses. Variable selling andadministrative expenses are not part of product cost under eithermethod.

Therefore they have to be distributed to cost centers on some sharing basic like floor areas, machine hours, number of staff, etc. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.